Mangudya acts on nostro accounts

By Ndakaziva Majaka

The Reserve Bank of Zimbabwe (RBZ) is in the process of setting up stabilisation facilities aimed at monitoring local banks’ nostro accounts to ensure they meet international payment obligations, businessdaily can reveal.

A nostro account is a bank account held in a foreign country by a domestic bank mainly to facilitate settlement of exchange and trade transactions.

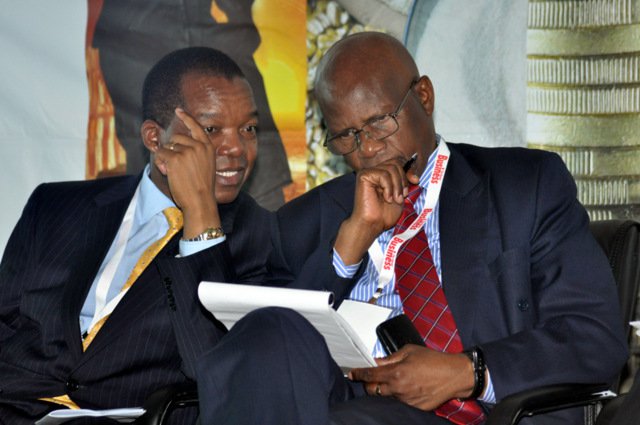

“We are organising stabilisation facilities to ensure that the gap between the demand for foreign currency and the amount that is available can be met while we are finalising the re-engagement process,” central bank governor John Mangudya said.

This comes as local banks are under fire from depositors for failing to meet client obligations leading to a shortage of raw materials locally.

In June, Zimbabwe experienced cooking oil shortages after local pressers failed to pay raw material suppliers — leading to a 30 percent slump in production — as banks struggled to release the cash from empty nostros.

Mangudya, however, said the central bank was leaving no stone unturned to ensure that vital imports are secured on time.

Zimbabwe is presently reeling from a cash shortage situation that has seen the apex bank intervene through various measures to stimulate production and retain cash within the country’s borders.

To monitor the use of foreign exchange, the RBZ has also crafted a priority list meant to ensure fair and equitable distribution of foreign currency reserves to priority areas within the country.

The list, which continues to be revised as the demands from the market are evaluated, has a special bias towards raw material imports for local manufacturers.

Local banks have even pleaded with deep-pocketed clients to bring cash in bulk so that they can service their nostro accounts as the country is failing to generate enough in export receipts to feed into the external accounts.

Bankers Association of Zimbabwe president, Charity Jinya, is on record saying financial institutions were now operating on a “know your customer” basis to determine where to get cash for day-to-day business.

The year began in a nostro chaos as local financial institutions made frantic efforts to secure new nostro account holders following the exit of German bank, Commerzbank, from the local market. Daily News