Bond notes launch on track says Zimbabwe central bank

By Ndakaziva Majaka

The Reserve Bank of Zimbabwe (RBZ) said it is “well on track” to unveil the bond notes in October, despite public resistance.

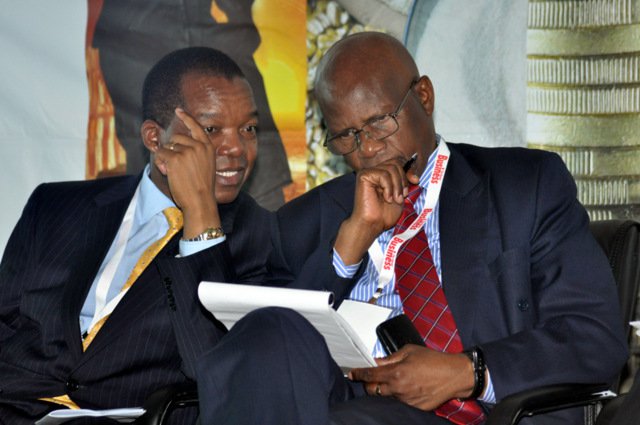

Last week, central bank deputy governor Kupukile Mlambo told the Daily News that despite the public’s concerns, the RBZ was geared to introduce the notes.

“October is still the introduction date… the process is not just printing, it also involves design, so we are well on track,” he said.

He, however, declined to indicate the current stage of the notes’ production.

“I cannot comment on that, the only person who can give you that information is the governor himself,” Mlambo said.

However, RBZ sources yesterday said the bank had received several designs, with the final templates expected to be submitted to the German printers by mid-August.

“As you may already know, the introduction date is October. As of now, designs have been received and they will be delivered to the printer by mid-month,” the source said.

The notes — which will serve as a five percent bonus incentive to exporters — will be introduced to sustain and safeguard the multi-currency system in Zimbabwe, amid public confusion over how the system will function after their introduction.

Vouchers for exporters to redeem the bond notes will soon be disbursed to all exporters who have been exporting since May 5 2016.

According to RBZ governor, John Mangudya, all exporters have been accruing the incentive since May 4 when the bond notes announcement was made.

The vouchers will be released dating back to all export transactions made from May 5.

In May, the governor announced that the RBZ was set to print bond notes under a $200 million Africa Export Import Bank-backed bond, but the development was interpreted by some quarters as an attempt to sneak the discredited Zimbabwe dollar through the back door.

Zimbabwe — which abandoned its currency in 2009 and adopted nine foreign currencies as legal tender — still has fresh memories of the 2008 hyper-inflationary era.

The proposed bond notes are set to make up four percent of the over $6 billion cash in circulation.

When the announcement was made, Zimbabweans — still traumatised by the inflationary effects of the bearer cheques — panicked, with depositors rushing to withdraw their cash from banks.

Market analysts say government needs to deal with issues of trust and honesty before introducing a currency of any sort. Daily News