Economists warn RBZ over deposit move

By Tatenda Dewa | Harare Bureau |

The Reserve Bank of Zimbabwe (RBZ) move to force major cash handlers to bank money on a daily basis to improve deposits will face resistance, economic analysts have said.

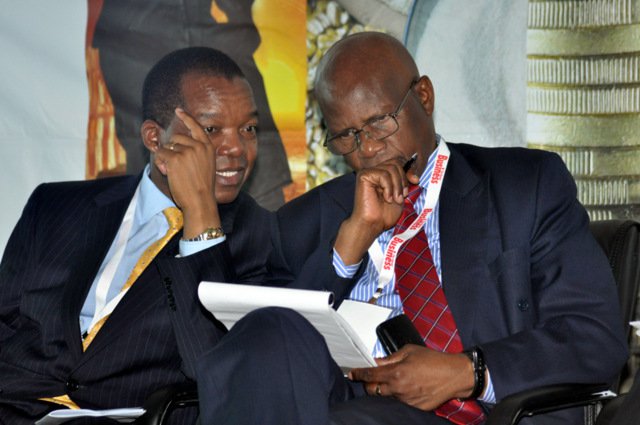

Finance minister, Patrick Chinamasa last Friday revealed to the national consultative assembly of the ruling Zanu PF that RBZ would invoke Section 11 of the Bank Use Promotion Act to monitor transactions by businesses generated large volumes of cash.

This will be done through an RBZ operation coordinated by the central bank’s Financial Intelligence Unit that began work last month.

Chinamasa said bank deposits had dipped by 40 percent in May, worsening the cash crunch that manifested in April and has forced banks to drastically reduce daily withdrawals.

Section 11 of the Bank Use Promotion Act reads: “Every trader and parastatal shall, unless it has good cause for not doing so, deposit in an account with a financial institution, no later than the close of normal business hours on the day following that on which the cash is received or on the next banking day, cash that is surplus to the requirement of the trader.”

Said Chinamasa:“The RBZ’s Financial Intelligence Unit invoked Section 6 of the Bank Use Promotion Act (Chapter 24:24), and has launched an operation targeted on assessing banking trends by high cash generators that include wholesalers, retailers, mobile phone companies, and fuel dealers. The first phase of this operation started on Friday the 3rd of June 2016.”

He added that RBZ, in moves reminiscent of the hyperinflationary era that former governor, Gideon Gono, presided over, was also monitoring cash deposit patterns.

However, economic consultant, John Robertson, told Nehanda radio that commerce was set to resist the surveillance and attempts to bully business into making the deposits.

“They (businesses) will look for ways to avoid making the deposits because it doesn’t make sense. Government will be faced with many legal challenges by corporate,” said Robertson.

He added: “It is strange that we are hearing about the law they will use for the first time. In the past, individuals and corporates did not have to be forced to bank their money because it was prudent to do so. This is no longer the case.”

He said depositors now considered their accounts unsafe because of high bank charges and severe difficulties in withdrawing money for operations, salaries and other overhead costs.

He feared that some companies might be forced to close down or informalise their businesses while potential investors would keep away, thereby adding to the economic crisis that Zimbabwe is currently grappling with.

He said the RBZ and government would face constraints in policing the businesses, adding that snooping on commerce might worsen corruption as public officers asked for kickbacks.

“There is increasing fear in industry and commerce that government is not being sincere with its intentions. In any case, this law does not guarantee freedom of choice that is stipulated by the constitution because businesses will be forced to act at the behest of the RBZ,” added Robertson.

During the Gono era, the RBZ raided foreign currency accounts and some of the victims have not yet been paid back.

Robertson said it was easy for businesses entities handling high volumes of cash to come up with legitimate excuses not bank their money on a daily basis.

Economist Christopher Mugaga said there was widespread mistrust of the financial sector and the economy.

“A bird in hand is worth two in the bush. There is a cash shortage and depositors are having problems taking their money out, so would rather keep what they have. Banking money is earning costs rather than interests,” said Mugaga.

Chinamasa acknowledged that there were reports of illicit cash deals on the black market.

He said government was working to arrest the cash crisis by also by putting in place export incentives, urging the Zimbabwe Revenue Authority to expand the tax base and promotion of the use of plastic money. Nehanda Radio