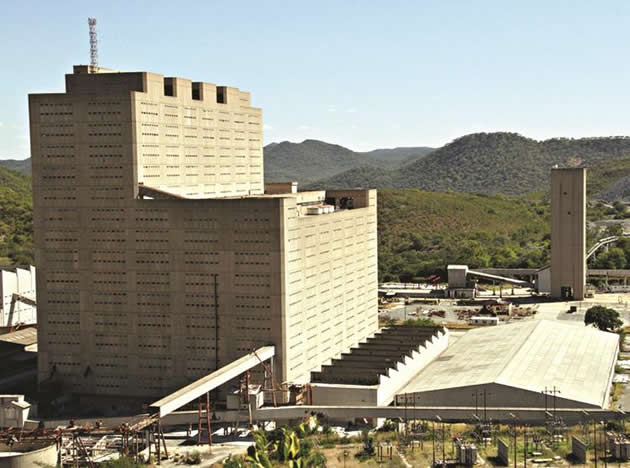

US$1billion needed to rescue Shabanie and Gaths mines

By Phillimon Mhlanga

At least US$1 billion is required to resuscitate SMM Holdings’ troubled Shabanie and Gaths asbestos mines, making the revival of the two mines a herculean task, the Financial Gazette’s Companies & Markets (C&M) can report.

The figure is significant for a country that has failed to attract foreign investors due to unfriendly economic policies, resulting in government failing to get any firm commitments from potential foreign investors who had shown interest to bail out Shabanie Mine in Zvishavane and Gaths Mine in Mashaba.

Government sources told C&M last week that Russians and Chinese investors had shown interest in the business but had been put off by the quantum of bailout cash required to resuscitate the mines.

It is understood that equipment worth millions of dollars has been trapped underground by rising water levels making it inoperative. This is made worse by the fact that the mines now have antiquated technologies which may require upgrading.

The longer it would take to re-open the mines, the more difficult it will be to restart operations, according to experts. This would also prolong the suffering of the already distressed workers who have gone for many months without being paid and the communities around these mines.

Government had targeted to first open Gaths Mine, which is still shallow and cheaper to resuscitate. Shabanie Mine runs for about a kilometre into the ground and requires a much bigger chunk of capital to revive. Gaths Mine is about 700 metres from the surface.

“It’s a financial issue,” said Francis Gudyanga, the permanent secretary in the Ministry of Mines and Mining Development.

“We are working on something. Depending on the level of resuscitation, for a start, we need at least US$1 billion,” he said.

“There has been some interest. There were some people who had shown interest in the mines (Shabani and Gaths mines). The potential investors came from Russia, China and some other European country. But we had no firm discussions,” Gudyanga said.

SMM chief executive officer, Chirandu Ndhlembeu, told C&M in November last year, that Gaths Mine was sitting on asbestos deposits worth more than US$1 billion. He said the asbestos deposits lying idle underground had a lifespan of 17 years, but could not be exploited unless the mine got a rescue package.

At one time SMM was the world’s sixth largest asbestos producer with an annual output exceeding 140 000 tonnes.

But the miner has been plagued by legacy issues, including a dispute over ownership pitting government and dispossessed former shareholder, Mutumwa Mawere.

Mawere lost control of SMM in 2004 after government accused him of pillaging the company’s coffers to pay for his shares previously held by Turner and Newall plc.

Mawere has denied these allegations, insisting his payment for shares was above board and not prejudicial to any stakeholder.

The expropriation of Mawere’s shareholding in SMM was done using a controversial law that allows the State to take over assets of businesses deemed to be insolvent and incapable of servicing debts owed to State entities.

Government appointed AMG Global Chartered Accountants’ partner Arafas Gwarazimba to administer operations until the two mines became viable.

He did not succeed in turning around the company’s fortunes. In fact, the takeover of the company by the State marked the deterioration of the company’s fortunes.

A Parliamentary committee recommended a few years ago that government should restore Mawere’s ownership of SMM to enable the mines to reopen.

But this has not happened.

A United Kingdom court ruled that Mawere’s Africa Resources Limited had legitimate title to the mining firm after the government-appointed curator took the dispute to the United Kingdom.

At its peak, the former asbestos mining giant employed about 7 000 workers.

Government has been facing challenges in securing funding for SMM and other State-owned mines such as Jena Mines, Mangura Copper Mines, Sabi Gold Mine and Sandawana Emerald Mines which are currently under care and maintenance, due to its own financial dire straits as well as Zimbabwe’s high country risk.

SMM closed in 2008, four years after government’s take-over of the company. Financial Gazette