New investors eye Ziscosteel

By Shame Makoshori

Global steel giants have begun moves to court the troubled Zimbabwe Iron and Steel Company (Zisco), only a few months after rumours of a possible pull out by Indian outfit, Essar Africa Holdings Limited (EAHL), began swirling in the market.

The Indians took a controlling stake in the once-State controlled giant, once one of Africa’s largest integrated steelworks, in 2011, and rebranded it to NewZim Steel. The deal is now said to have collapsed, although government vehemently denies this.

Industry and Commerce Minister, Mike Bimha, told a recent Confederation of Zimbabwe Industries (CZI) meeting that there was interest in steel manufacturing from unnamed global players.

“My ministry is inundated with investors who want to invest in Zisco. We also have an investor who is making enquiries to go into stainless steel. This investor is number two in the world in terms of stainless steel and they want to invest in Zisco,” he said.

Bimha has previously insisted that EAHL were still involved with Zisco and that the Indian firm had taken a break due to falling steel prices.

EAHL’s Zisco deal suffered its first frustrations from endless bickering in the then inclusive government between 2009 and 2013, with some government arms declining to transfer iron ore claims that had been part of the deal.

Last week, the Financial Gazette’ heard that a dramatic decline in global steel prices, which rocked markets in the past year, was the final straw that could have pushed EAHL out of the Zisco deal.

Bimha declined to say who had made the overtures for Zisco, and also refused to categorically state if EAHL had pulled out of the country.

But he said government was considering several options to find solutions for Zisco.

“What has happened is that the prices of steel and iron ore have gone down,” he said in response to enquiries over the prolonged delays in resuscitating the company.

“It is something we had never expected and investors are not happy to part with money. We have to go back to the drawing board. Maybe we need to look for an investor who is not worried about prices, but whatever happens we want Zisco Steel back.”

The fall in steel prices has indeed made investment in the sector very difficult, but there are indications that investors with a long-term horizon may be interested in Zisco’s assets, although they may bargain for significant discounts and concessions.

Inevitably, President Robert Mugabe’s administration would have to review its policies, which have discouraged foreign investment into the country.

Luxemburg-based ArcelorMittal, which bid for Zisco’s assets alongside EAHL about five years ago, may still be interested in the business and its assets.

Government did not particularly want ArcelorMittal, the world’s largest steel producer, because it considered it “too big” and therefore a political risk. It has operations in 60 countries and employs about 260 000 people.

In 2014, ArcelorMittal produced 98 million metric tonnes, of steel, followed by Japan’s Nippon Steel & Sumitomo Metal Corporation, which produced about 47,09 million metric tonnes of steel.

China’s Hebei Steel was the third largest.

Based on these numbers, it is possible that the company Bimha said has been “making enquiries to go into stainless steel” could be the Japanese firm, which plays second fiddle to ArcelorMittal on the global steel market.

The case for Nippon Steel & Sumitomo Metal gets even stronger considering that President Mugabe was in Japan a few months ago, where he took advantage of the trip to drum up support for investment in Zimbabwe.

Bimha was part of the delegation.

Bimha, however, insists government is still determined to work with EAHL in reviving Zisco.

“Even if we find an investor we will go with the current investor,” he told the CZI congress.

Government and EAHL announced the launch of New Zim Steel (Private) Limited and NewZim Minerals (Private) Limited after closing the transaction that started in August 2010 with a public tender for a majority stake of government’s shareholding in Zisco.

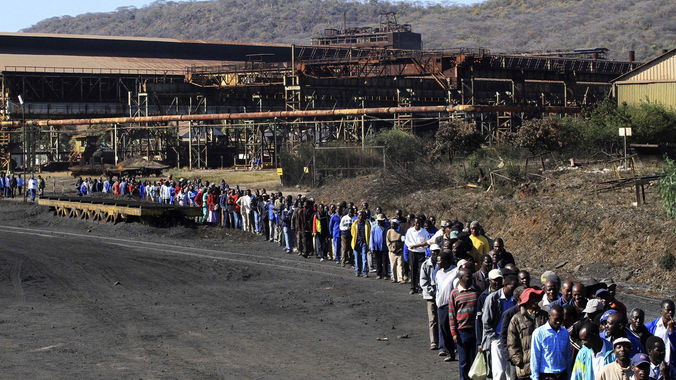

The launch was expected to begin a new chapter in the economic growth of Zimbabwe and particularly for the communities in and around Redcliff and Chivhu, which harbour massive iron ore deposits.

In accordance with the agreement entered into in 2011, EAHL committed to an investment of approximately US$750 million, which would have relieved government and Zisco of all its liabilities, which included guaranteed foreign debt, historic liabilities in respect of trade and other creditors including unpaid salaries and associated benefits owed to the employees, fixed capital investment for reviving the plant to 1,2 million tonnes per annum steel production and working capital requirements of the operations.

NewZim Minerals was also earmarked to takeover vast iron ore deposits formerly held by Zisco. Financial Gazette