RBZ chief to lead debt team to Europe

GOVERNMENT on Wednesday said it would dispatch a high level team of officials to three European capitals to appraise key creditors about the country’s dire economic situation as efforts to find a solution to a debt crisis intensifies.

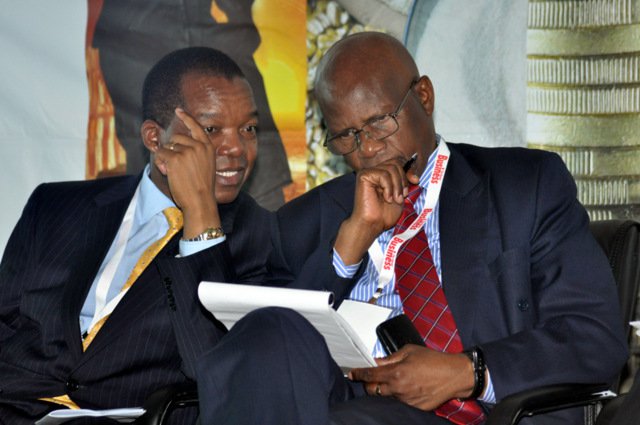

The team, to be led by Reserve Bank of Zimbabwe governor John Mangudya, would visit Brussels in Belgium, the French capital Paris and Berlin in Germany with a mandate to make key creditors understand the situation in Zimbabwe and appraise them about efforts being undertaken towards debt clearance.

The country’s debt is approaching US$10 billion, with massive arrears.

Finance Minister, Patrick Chinamasa said the team would travel to Europe ahead of the annual meeting of the World Bank (WB) and the International Monetary Fund (IMF) in Lima, Peru, next month.

“In preparation to the Lima meetings, I am sending a team to Berlin, Brussels and Paris to sensitise creditors of the situation we have and the strategies we hope to promote in Lima,” Chinamasa said after meeting an IMF delegation that is in the country to review its Staff Monitored Programme (SMP) with the country for the period ending June 2015.

Zimbabwe’s arrears with three multilateral financial institutions – the IMF, the WB and the African Development Bank (AFDB) – currently stand at US$1,8 billion.

At the end of the first half of this year, the country’s public and publicly guaranteed debt was estimated at about US$8,4 billion, with an external debt of US$6,7 billion and a domestic debt of US$1,7 billion. The IMF has warned that the country is in debt distress.

It says steps should be taken by the southern African country to make efforts towards debt clearance. This is expected to open opportunities for international financial support, which is critical for resolving a long drawn economic crisis that has triggered the closure of thousands of firms, job losses and extensive capital flight.

The country has recently been attempting to make token payments to key creditors, but again, this has been at the expense of social service funding, with hospitals running out of drugs and sanitation deteriorating.

Earlier this week, Chinamasa said the country was intensifying its engagement processes with multilateral creditors to find ways of getting them to agree on possible accommodation agreements that would result in Zimbabwe accessing international capital.

The country is due to meet the multilateral creditors on the sidelines on the Lima meetings.

Yesterday, the Finance Minister said the meetings in Lima, Brussels, Paris and Berlin would be key in spelling out the strategies towards debt clearance.

“The end game is to clear the arrears (with the IMF, WB and AfDB),” said Chinamasa.

“That will give us a stepping stone to engage the Paris Club. That is the path we are chatting for ourselves,” said Chinamasa.

In a show of confidence on the progress made towards implementing economic recovery policies, head of the IMF delegation visiting Zimbabwe, Domenico Fanizza, said the country had met the structural benchmarks agreed under the SMP for the period ending June 2015.

Fanizza said the IMF had been impressed by the country’s moves towards liberalising the labour market and steps towards restructuring government finances.

“Zimbabwean authorities have moved forward with reforms despite difficult financial and economic reforms,” said Fanizza.

He said the ongoing SMP processes were aimed at finding solutions that would eventually allow the country to access international financial support from the IMF, the WB and the AfDB.

“So far, Zimbabwe has not been able to receive support from the IMF, World Bank and ADB because it has incurred arrears,” he said. September 9, 2015. Financial Gazette