By Letwin Nyambayo

The bond note continues to suffer heavy battering against the greenback on the parallel market, with its exchange rate touching new lows.

The surrogate currency was trading at over 400 percent against the United States dollar yesterday, compared to 180 percent at the beginning of the month.

The rate now matches that of the Real Time Gross Settlement System (RTGS), which used to trade slightly better than the bond note.

As of yesterday, the Old Mutual Implied Rate had shot up to 620 percent up from Monday’s 213 percent, according to the Premier Alternative Market Tracker in Zimbabwe (Zim Bollar Index).

As of Monday, bond note to South African rand has risen from 23 percent to 25 percent while the Pula is at 35 percent up from 22 percent.

Economists told the Daily News that the soaring of rates indicates that people were frantically trying to get rid of their RTGS balances and the bond note to preserve value.

Economist Simbarashe Gwenzi said speculative behaviour, panic buying and policy inconsistency resulting from the uncertainty bedevilling the economy since the announcement of the monetary and fiscal policies will continue to drive rates.

“Perception is really critical and the inability of the Finance minister and the Reserve Bank of Zimbabwe (RBZ) governor to speak the same language is fuelling the hike.

“There’s a lot of confusion surrounding the pronouncements of the Finance minister in the UK and the government position of the bond to USD rate being at par.

Unfortunately, for the new minister every word he speaks will be taken seriously, there’s no room for slip ups,” he said.

Gwenzi said people were now hesitant of the return to the dollarisation process when bearer cheques became redundant.

He said the stabilisation of the exchange rates would be determined by whether the Finance ministry and the RBZ secure a bail-out package to improve market liquidity.

Without such a financial package, the rate will continue to increase.

Another analyst Denford Mutashu concurred that the rejection of bond notes by the public, the stampede to offload the currency and RTGS balances by both the public and business had pushed the rates.

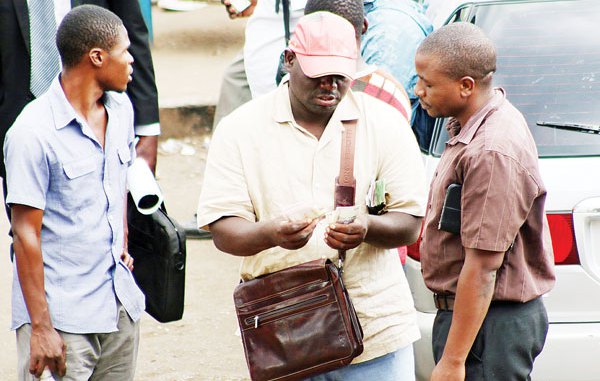

Mutashu said parallel market dealers were simply cashing in on the situation which is lucrative to them while decimating business and people’s savings. “The forex rates are scary but real. As business, we hope for the best out of this difficult situation.”

Economist Godfrey Kanyeze said since the launch of the fiscal and monetary reforms, people now want to protect value of their money and this has triggered rates to soar.

“Business has already stated that the two cents per dollar transaction tax will hit them hard. Given the subsequent launch of the macroeconomic and fiscal stabilisation programme, which is an austerity programme, people expect the situation to deteriorate further, and hence the increased demand for foreign currency to protect value and restock, which in the context of forex shortages pushes the parallel exchange rates.

“In turn, businesses increase prices. Some raise prices to maintain their positions, making an already difficult situation worse,” he said.

Since the announcement of the fiscal policy by the minister of Finance, the market is rejecting the bond note with some retailers refusing to accept them as a medium of exchange.

This trend has triggered a high demand on foreign currency which in turn has negatively impacted the rates. DailyNews