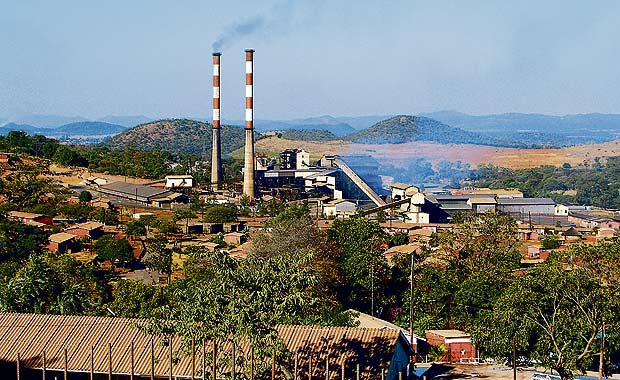

Listed mining concern Bindura Nickel Corporation (BNC) says it is operating on shaky ground despite recording $5,8 million after-tax profits in the full year to March 31, 2018. The group’s chairperson Muchadeyi Masunda said despite posting healthy profits, BNC’s total assets exceeded total liabilities by $46,1 million.

The group’s current liabilities exceeded its current assets by $4,7 million. Consequently, the group’s ability to continue as a going concern is dependent on its ability to generate positive cash flows,” he said.

BNC’s troubles started last year when the company’s directors Yim Chiu Kwan, 63, and Yat Hoi Ning, 61, are alleged to have defrauded the firm of over $2,7 million. The duo is currently on the police wanted list.

Masunda said the company’s current directors are of the view that the group will be in a position to finance future operations, complete with the smelter project and settle any liabilities that may occur in the ordinary course of business.

BNC’s $21,5 million smelter project, which was expected to be completed last year, is yet to be finished.

“The delay in completing the project was caused by constrained cash flows for financing the remaining work due to prevailing low nickel prices.

“While plans are still at hand to complete the project, the decision to restart production at the smelter will still depend on the nickel prices, availability of additional concentrates from third parties and a lower power tariff,” Masunda added.

In 2015, the troubled miner raised $20 million through a bond issue to finance the restart of the smelter through a five-year bond with a coupon rate of 10 percent per annum. A total of 26,5 million was required for the smelter restart project.

BNC had planned to finance the balance after the $20 million bond issue from internally generated resources.

In the period under review, the company’s revenue increased by 19 percent to$53,6 million, compared to last year’s $45,1 million on increase in average nickel price realised in the year.

The listed miner’s output from milling activity for the year under review was 390 211 tonnes compared to 440 619 tonnes in 2017.

The 11 percent decline was attributable to a deliberate strategy to focus on production of massive ores in order to mitigate the challenges concerning the availability of equipment.

Nickel production of 6 620 tonnes was lower than last year’s output of 6 762 tonnes.

Masunda said the decline was in line with the lower milled tonnage.

— The Financial Gazette