Zisco revival costs taxpayer $500m

By Dumisani Ndlela, Deputy Editor

Government will this week gazette a debt assumption bill for the Zimbabwe Iron and Steel Company (Zisco), to clear the way for its takeover of $500 million obligations owed to both local and international creditors, Finance Minister Patrick Chinamasa said yesterday.

Chinamasa said the move was meant to expedite the takeover of Zisco by Chinese firm R&F. In terms of an agreement reached by government and the investor, Zimbabwe would retain some shareholding in Zisco’s mining assets, while R&F, through the Hong Kong-registered Tian Li, would take full control of the steelworks.

President Emmerson Mnangagwa, who took over from Robert Mugabe in November last year after a military intervention that forced him to resign, this week vowed to take concrete steps towards Zisco’s resuscitation within 100 days of his presidency.

“As far as I am concerned, the Chinese investor is fully committed to this venture,” Chinamasa told a business breakfast meeting in Harare yesterday.

A highly placed source at Zisco said although all workers, including the chief executive officer, Alois Gowo, had been retrenched with effect from August 31, 2016, Gowo and a few executives were still working for the steel producer “on a month to month basis” to facilitate the handover to the new investor.

“Understandably, the new investor is working with the Zisco board and the retrenched executives until a hand over is made,” said the source.

An extraordinary general meeting (EGM) of shareholders will be held on February 8 to discuss the debt assumption, which will pave way for takeover of the company by R&F, which will invest $1 billion into the company.

R&F will assume control of the company through a subsidiary called Tian Li, which is registered in Hong Kong, according to officials familiar with the transaction.

This week, Zisco sent out a notice to shareholders, announcing the EGM at which minorities’ consent for the takeover of the company’s debt by government, in return for the cancellation of their shares and any pre-emptive rights will be sought.

Zisco’s minorities hold about 11 percent shareholding in the steelmaker.

Should that resolution be voted for by shareholders, directors of the Zisco board, chaired by former banker Nyasha Makuvise, will immediately cancel 22 011 261 ordinary shares held by minority shareholders in the company.

The shareholders will also be asked to ratify an agreement entered into for the sale of Zisco’s entire assets to Tian Li, with tagged assets, which include coke ovens, being sold to ZimCoke.

Government holds an 89 percent stake in Zisco, and the balance is held between Lancashire Steel, Stewart & Lloyds and Tanganyika Investments.

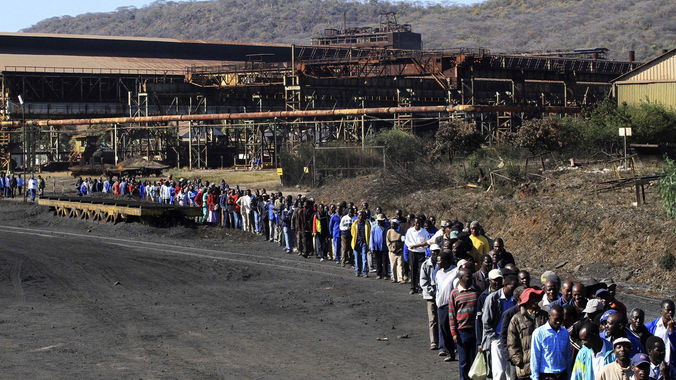

Zisco, once one of the largest integrated steel companies in Africa, stopped operations in 2008 after failing to secure cash for the refurbishment of its antiquated plants.

A highly placed source said government was taking over a debt of $500 million under the deal.

“The debt has obviously gone up because it is not being paid,” said the source who is familiar with the transaction. The debt includes outstanding salaries to workers, as well as statutory obligations to the National Social Security Authority and the tax collector, the Zimbabwe Revenue Authority.

A significant part of the debt is owed to international creditors.

In 2009, the Zisco debt to creditors stood at $300 million and was a major talking point in an abortive takeover of the company by Indian conglomerate, Essar Africa Holdings Limited (EAHL) in 2011.

EAHL had committed to investment approximately US$750 million into Zisco, relieving government and Zisco of all their liabilities, which included guaranteed foreign debt; historic liabilities in respect of trade and other creditors, including unpaid salaries and associated benefits owed to the employees; fixed capital investment for reviving the plant to 1,2 million tonnes per annum steel production; and working capital requirements for operations.

EAHL withdrew from the project in 2015 due to bickering within government, which stalled its development plan and frustrated bankers.

Under the latest plan, R&F is planning to invest US$1 billion to revive the company, Industry, Commerce and Enterprise Development Minister Mike Bimha told this newspaper in August last year. He indicated that steel output was expected to start within 18 months of negotiations being completed.

“We are looking at an initial injection of over US$1 billion and it will probably come to US$2 billion when we proceed but it’s not a small project; it’s a huge project and a lot of work to be done,” Bimha said after introducing R&F founder Zhang Li to Mugabe.

This week, Bimha declined to reveal details on the transaction, saying: “Just wait for an announcement very soon. It’s part of our 100-day plan.”

Makuvise, the Zisco board chairman, confirmed the deal was proceeding, and that Tian Li was a unit of R&F. The Financial Gazette