Six prospective investors, including a consortium of non-resident Zimbabwean professionals, are in the running for the National Railways of Zimbabwe recapitalisation project, with the winning bid expected to be announced before the end of the month.

However, excitement over the NRZ’s potential revival has been dampened by government’s recent conduct in the abortive resuscitation of Ziscosteel.

On Tuesday, the State Procurement Board revealed that the Diaspora Infrastructure Development Group (DIDG) — in partnership with South Africa’s Transnet — SMH Rail of Malaysia and a local affiliate of Swiss Accountancy firm Crowe Horwath were among the bidders for the NRZ recapitalisation project, estimated to require $400 million.

The other bidders are Croyeaux Limited of Zimbabwe, Sino Hydro of China and China Civil Engineering Construction Corp.

DIDG, fronted by Johannesburg-based Donovan Chimhandamba, proposes to put up $400 million and rope in Transnet as a technical partner. SMH Rail has a $101 million funding proposal, while Croyeaux’s plan involves $700 million.

Crowe Horwath said it would be able to secure $2,5 billion. Chimhandamba told the Financial Gazette that his consortium involves non-resident Zimbabweans, most of them being South Africa-based professionals.

“We have raised $400 million on a structured finance basis,” Chimhandamba said, adding that his consortium’s proposal would entail the creation of a separate joint venture company with the NRZ.

Transnet would come in as a technical partner, given its strategic assets and regional footprint.

“Transnet is a technical partner. It’s not just a financial solution, looking at the capital requirements. For us, the market is a regional play. The real value is in capturing the regional market and Transnet is key in that regard,” Chimhandamba said, citing the South African firm’s forays into Zambia and the DRC as well as its port infrastructure.

Speaking at the announcement of the bidders in Harare on Tuesday, NRZ board chairman Larry Mavima indicated that a winner could be announced before the end of July.

“What we are going to now is to go through an adjudication process in which we will eliminate those that have failed to meet the basic requirements. That we should be able to do within the next 10 days.

“In the next 10 days we should be able to come up with recommendations as to who the winning bidder is,” Mavima said.

“We are looking at total recapitalisation and, of course, rearrangement of the balance sheet of NRZ. It is not an easy tender, we want the recapitalisation and modernisation of NRZ.”

The NRZ owes government $200 million in statutory payments, $128 million in salary arrears and $150 million to third parties.

The parastatal is vital to Zimbabwe’s economy, which would benefit immensely from its revival.

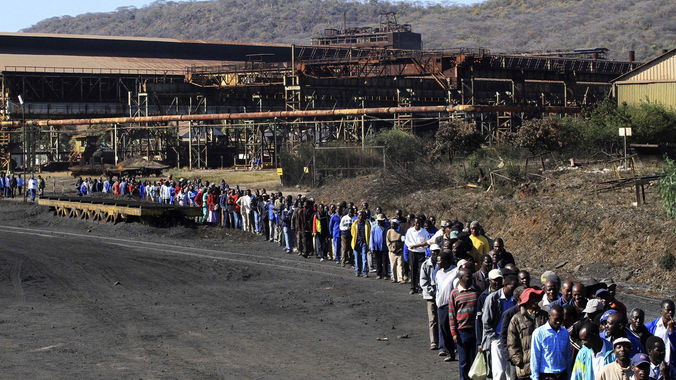

But questions remain on the government’s ability to get private investors on board, following the abortive attempt to revive moribund steel firm Zisco.

In 2010, government signed a $750 million deal with India’s Essar, which would see the company assume majority control of the steel firm. However, the deal unravelled after years of government’s inability to honour its commitments to Essar.

Essar had beat off several rivals, including ArcelorMittal and Jindal Steel, to land the tender to take over Zisco, with its conquest being celebrated at an elaborate 2011 event attended by President Robert Mugabe and his then power-sharing Prime Minister Morgan Tsvangirai.

The deal soon ran into trouble over the iron ore mineral rights that had been written in, but which hard-line elements in Mugabe’s government found unpalatable. Financial Gazette