Data services company Africom Holdings (Africom) continues on a downward spiral, as some of its movable assets were auctioned in Harare on Thursday for failure to meet certain unspecified obligations to Europe-based Skyvision Global Network (Skyvision).

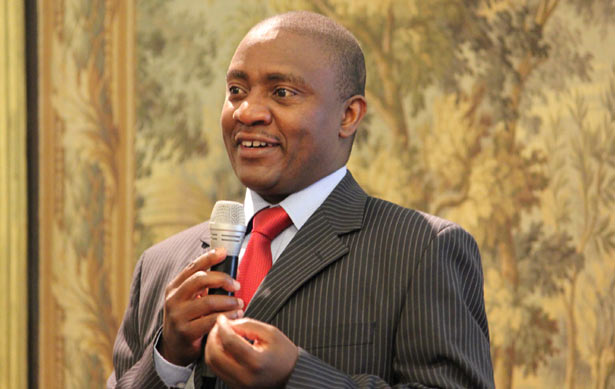

Apart from the latest debacle and setback, Kwanayi Kashangura’s company has been rocked by a number of operational problems such as the 2011 boardroom squabbles, which saw two key investors being charged for espionage and institutional investors, including Old Mutual Zimbabwe (OMZ) and Douglas Hoto’s First Mutual Limited (FML) considering an exit from the group.

And as Africom’s woes mount, the company is set to lose – under proceedings sanctioned by the High Court and superintended by LM Auctioneers – a number of vehicles, office equipment and generators.

The development also comes as Kashangura has reportedly left the group under pressure from other shareholders and in July the converged communications firm was dragged to court by a local bank over a $1,7 million in refinancing loans advanced to it five years ago.

According to reports at the time, Africom had accessed a $15,8 million syndicated facility to buy telecommunications equipment from the Africa Export-Import Bank and guaranteed by Fernhaven Investment, and the National Social Security Authority (Nssa), which was a five percent shareholder in the beleaguered company.

And as the technology firm has found the going to be tough – in a market dominated by the likes of Econet Wireless – Kashangura has not only bowed out, but seen its fortunes continue to sink along with Zimbabwe’s fast-deteriorating economic fundamentals.

Even, though, the strong-willed businessman had clawed his way back to the helm of the company after a nasty fallout with Simba Mangwende and Farai Rwodzi, the founding Africom chief executive has had to fend off many ouster bids and boardroom fights, which typify the turmoil that has characterised the company since its emergence nearly 20 years ago.

In 2012, the firm was rattled by a shareholder mutiny or desertion when OMZ and FML indicated a desire to sell their combined 32 percent stake after the problems that had rocked the company the prior year.

Around the time he was battling the incoming shareholders, Kashangura himself had been fighting allegations of financial impropriety arising from a forensic audit done at the company.

While the 28 percent shareholder was tussling OMZ and other cash-rich institutional investors over pricing issues for the sale or disposal of their stake, there were also indications that Nssa was planning an exit. Daily News