By Phillimon Mhlanga

A US$102 million deal meant to resuscitate Kamativi Tin Mine in Matabeleland North is on the verge of collapsing after the Zimbabwe Mining Development Corporation (ZMDC) questioned the credentials of the potential partner.

The Financial Gazette’s Companies & Markets has learnt that the intended partnership between ZMDC and a Chinese firm, China Beijing Pinchang will not be concluded.

The Chinese company was supposed to take up 49 percent of Kamativi while ZMDC would have remained with a controlling stake of 51 percent.

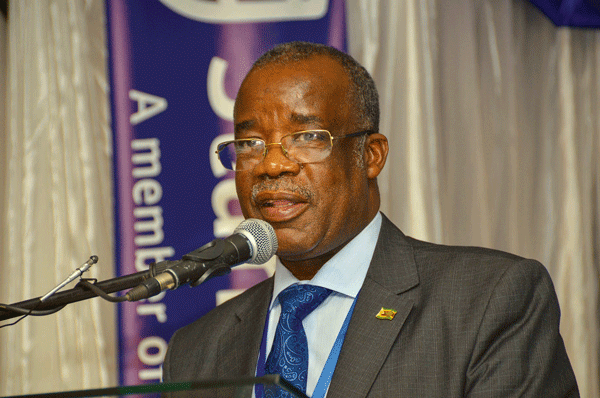

Permanent secretary in the Ministry of Mines and Mining Development, Francis Gudyanga, said: “ZMDC wanted to go into a partnership with a Chinese company but after a due diligence was done, it was found that its status was not satisfactory, meaning that we might be forced to look elsewhere for the resuscitation of Kamativi.”

Kamativi has tin, lithium, tantalite, beryl, copper and beryllium deposits.

The new investor had plans to set up a refinery at the mining site for the minerals.

About US$102 million was required to resuscitate operations at Kamativi, which was shut down in 1994 due to unviable commodity prices on the international markets.

Tin prices had crushed from about US$18 000 per tonne to less than US$3 000 per tonne.

At the moment, international prices of tin are hovering between US$15 000 and US$22 000 per tonne.

The closure of the mine resulted in the loss of employment at the mine, which at its peak was one on the biggest underground mines in Africa employing more than 1 500 people.

The mine was opened in 1936 and at the time of its closure in 1994, it employed about 800 people. At its peak, Kamativi produced one million tonnes of the base metal annually. The Financial Gazette