More companies to close

More companies could be heading for the corporate graveyard during the second half of the year as lack of cheap working capital, high labour costs and stiff competition from imports continue to choke industry and commerce.

Business also has to contend with using antiquated equipment, high licence fees and utility bills that are making the revival of local industries impossible in the short-term.

And as more companies head for collapse, there is one group of individuals who are, however, rubbing their hands in glee: Liquidators and judicial managers.

Like undertakers, they thrive on the collapse of companies, and with the turbulence in industry and commerce, they are at the beck and call of those who find the going tough.

Judicial managers and liquidators, who take over management of firms under liquidation, charge either a percentage of the portfolio or asset value of the company, which is negotiated up to about 5,5 percent.

They can also charge an hourly commission, which is more like a moving target and they can earn more than the shareholders and creditors.

The past five years have seen local firms bleed heavily, with many of the struggling companies stampeding to the High Court in search of refuge from marauding creditors under the guise of judicial management.

Even court-appointed administrators are finding it more and more difficult to revive the distressed companies that have been placed under judicial management, with creditors, particularly banks and employees, walking away with nothing after liquidation.

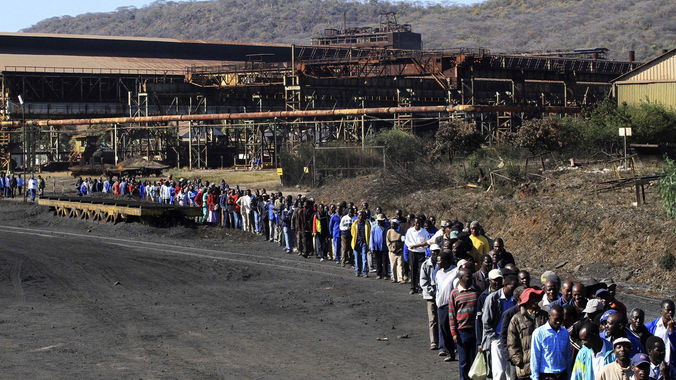

Official data shows that over 6 000 companies closed shop between 2011 and March this year, with nearly 75 000 workers losing their jobs.

Zimbabwe Congress of Trade Unions secretary-general, Japhet Moyo, said at least 81 companies from three sectors closed shop since January due to viability constraints.

The closures, Moyo said, were from the hotel and catering sector, which was the hardest hit with 69 companies shutting down; the mining sector had seven casualties while the engineering sector had five companies twisting in the wind.

According to data obtained from the Master of the High Court, a total of six companies were placed under judicial management, while 13 were liquidated during the first quarter of 2016, compared to 11 and 17, respectively during the same period last year.

The majority of companies cited restructuring and downsizing as the reasons for retrenchments. This was mainly due to viability challenges, redundancy, judicial management and rationalisation.

Economic analyst, Evonia Muzondo, said the outlook for the second half looks gloomy for companies operating in Zimbabwe. She said demand was waning as customers had low disposable incomes and the current liquidity crisis has eroded incomes.

Civil servants make up 60 percent of the employed population, and delays in the payment of their salaries impacted negatively on demand.

Recently, government imposed a ban or restriction on the importation of a number of products, among them a wide range of basic commodities.

This, said Muzondo, will inevitably affect some businesses.

“Some companies were surviving on imports – importing finished goods and selling them; if they cannot import or import less this will eat into their revenue and profitability. Some companies will, however, benefit from the import restrictions especially those that produce locally,” said Muzondo.

“Yes more company closures will be witnessed this year as there is no catalyst in the short-term to reverse the current trend. Companies are in serious need of recapitalisation and they are failing to generate the cash or access cheap loans for working capital,” she said.

The company closures will result in government revenue being negatively affected, thus missing its targets. There will be less money from direct taxes, company taxes, value added tax and Pay-As-You-Earn.

This means the little money that is going to be collected would be channelled towards salaries and consumption, leaving little or none for development.

“A holistic approach is needed not piecemeal solutions. The political environment needs to be sorted out first. Protests do not augur well in the eyes of investors whose companies desperately need to attract in order to raise funding for recapitalisation to retool and reorganise to increase production,” Muzondo said.

The Reserve Bank of Zimbabwe said, during the first quarter of 2016, a total of 949 retrenchments were witnessed, compared to 1 011 over the same period in 2015.

While industries have collapsed under the weight of a crippling liquidity crunch that has wreaked havoc on the markets since 2011, there has been little movement on the part of government to save troubled firms.

Finance Minister Patrick Chinamasa, who is expected to present his mid-term fiscal policy review soon, has failed to roll out any bailout packages in his last two National Budgets.

Economist and former Zimbabwe National Chamber of Commerce chief executive officer, Trust Chikohora, said the country was likely to see more company closures because the economy was slowing down immensely due to limited liquidity.

“There is some kind of gridlock emerging. Obviously government revenue will simultaneously dwindle because it is a function of economic activity. I want to reiterate that we must go back to basics. Resolve the land issue once and for all, dealing with security of tenure for serious farmers,” he said.

Chikohora said measures were needed to urgently revive the economy. These included repeal of the Indigenisation and Economic Empowerment Act so as to facilitate foreign direct investment. He said Zimbabweans needed to shun corruption and reward hard work, and to re-engage the international community and resolve the unsustainable debt burden.

The country’s domestic and foreign debt is currently around US$10,6 billion.

“As a country, we should guarantee the rule of law without fear or favour and to resolve the underlying political issues to build confidence. These are the major issues,” Chikohora said.

The mining industry, which contributes 15 percent of the country’s gross domestic product, has also not been spared. The industry is battling to contain debilitating costs and could slide into further difficulties due to the fall in mineral and metal prices caused by a slowdown in China, the world’s largest consumer.

Oxlink Capital’s chief executive officer, Brains Muchemwa, said he did not see any slowdown in company closures, adding that the downside risks associated with the deflationary environment would persist well into the second half of the year.

“Considering the levels of septic debts sitting on most of the balance sheets, fore-closures are likely to remain pronounced in the short to medium term,” he said. Financial Gazette