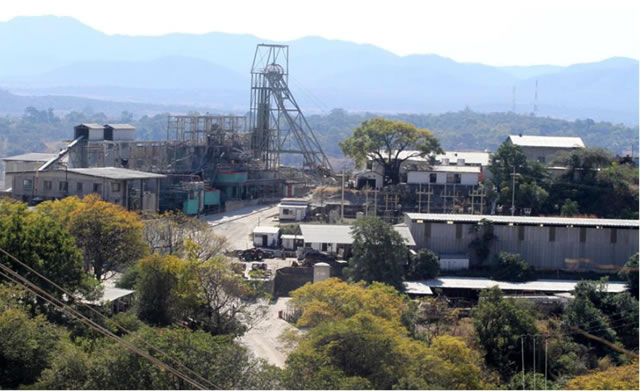

CAM and Motor, once Zimbabwe’s largest gold mine is expected to resume production next year, its parent company, RioZim Limited said in a statement.

RioZim, a diversified resource firm said the conclusion of the $10 million rights issue in July “has secured” the future of Cam and Motor and the plant will re-open in the second quarter.

Cam and Motor, which produced 150 tonnes in its entire life before it was closed, was Zimbabwe’s largest producer of the precious metal, doing underground mining then.

“Orders have been placed with a Chinese company for the manufacture of a plant with a capacity of 2 500 tonnes of ore per day,” said RioZim.

“Plant commissioning is scheduled for early 2016 and the project is expected to produce 120 kilogrammes of gold per month.”

RioZim is treating ore dumps from Cam and Motor at a rented plant and in the half-year ended June this year, gold contribution from the project amounted to just over 100 kg. The arrangement will continue until the group commissions its plant at the mine, the group said.

At Renco Mine, another of RioZim’s gold operations in the country, output during the period under review was 366kg, up 24 percent from the previous comparable period.

The increase resulted from a 10 percent improvement in grades and 14 percent in ore generation.

Empress Nickel Refinery is expected to resume operations in the first quarter of next year.

“The company did not receive matte from its sole supplier . . . (which) is facing some constraints but has committed to resume suppliers in Q1 of 2016.

“The company is also engaged with alternative local matte suppliers and once negotiations are concluded, it is anticipated that these suppliers could start as early as Q2 of 2016,” said RioZim.

Murowa Diamonds, in which RioZim has 22 percent shareholding will resume operations in the fourth quarter following nine months of stoppage, but losses will continue into 2016.

The subdued activity across the group’s operations saw the company recording a 41 percent decline in revenue to $23,1 million compared to $39,4 million in the comparable period last year.

“Operating profit narrowed to $2 million from $4,6 million, despite growing administrative costs at ENR, which is under care and maintenance.

The debt restructuring exercise is being pursued, which may see the group’s debt restructured from short to long term at a lower cost.

Over the past few years, the group’s fortunes have been overshadowed by debts, which, due to high interests have remained stagnant regardless of significant payments.

The ongoing restructuring exercise, which will result in the unbundling of the group into five units will make it easier for subsidiaries to raise capital without compromising its indigenous status. The Herald