Zisco risks collapse as Essar pulls out

By Phillimon Mhlanga

An Indian investor has pulled out of the Zimbabwe Iron and Steel Company (Zisco) and stopped engagement with government on the planned revival of the Redcliff-based steel producer due to complications involving the steel-maker’s global debts, the Financial Gazette has learnt.

The move effectively seals the fate of the deal, which first stalled due to bickering within the inclusive government over mineral concessions. The deal later suffered from government pressure to have the Indian firm takeover all government debts.

Essar Africa Holdings Limited (EAHL) took over the beleaguered steelmaker, which had been rebranded NewZim Steel in 2011.

Zisco was once one of Africa’s largest integrated steelworks.

The takeover was widely publicised with government and EAHL jointly announcing, at the official handover ceremony on August 3, 2011, the launch of two entities, NewZim Steel (Private) Limited and NewZim Minerals (Private) Limited.

NewZim Minerals was earmarked to takeover vast iron ore deposits formerly held by Zisco but the deal was stalled by bickering within the inclusive government, which ended with elections in 2013 that delivered a landslide victory for ZANU-PF, which went on to form its own government.

Reports have previously suggested that EAHL had been contemplating pulling out of Zimbabwe over delays in finalising its rights over iron ore claims that anchored its takeover of the beleaguered steelmaker.

But these reports had been vehemently denied.

Last week, Minister of Industry and Commerce, Mike Bimha, however, said the Indian firm had finally ditched Zimbabwe after endless battles to resolve Zisco’s indebtedness and other issues.

“So the investor had to take a break and said when you are ready, we will come back,” said Bimha while addressing a Zimbabwe National Chamber of Commerce (ZNCC) conference.

He indicated that it was not clear if Essar would come back to Zimbabwe, saying: “There are few investors who will come back after taking a break. When they do come back, things would have changed. The prices of steel are not static.”

He said it was therefore impossible for him to say when operations would resume at Zisco.

“This is the question which I always want to avoid because when I go to Parliament every Wednesday, I always face the same question on NewZim Steel,” said Bimha.

“First of all, I want you to understand that the Zisco deal is not just a normal deal. So issues of time don’t come into play. It is a very complicated deal.

“The investor didn’t come to Zimbabwe (on their own accord). We went out to them because we had a big problem of huge debt. Ziscosteel had incurred a huge debt. Government was a guarantor and there was no way government was going to pay for that. So we had to look for a partner.

“What makes the deal very sophisticated is that various creditors are told we want to take over your debt, and they say no, we don’t want you (to). How do you go into such a deal? It’s just a complicated deal,” said Bimha, explaining EAHL’s exasperation with the project.

In terms of its agreement with government, Essar committed to an investment of approximately US$750 million, which was to include relieving government and Zisco of all its liabilities.

This included guaranteed foreign debt, historic liabilities in respect of trade and other creditors, including unpaid salaries and associated benefits owed to the employees, fixed capital investment for reviving the plant to 1,2MTPA (million tonnes per annum) steel production and working capital requirements of the operations.

Subject to the conclusion of discussions with minority shareholders, NewZim Steel was to be owned 40 percent by government and 60 percent by EAHL.

This company would acquire the existing assets of ZISCO and would revive and expand ZISCO’s steelmaking capacity in two phases.

The first phase involved the refurbishment of the plant at an investment of US$115 million, which was to be completed in 12 to 18 months. This was expected to deliver a production capacity of 0,5 MTPA.

The second phase was to involve the increase of production capacity to 1,2 MTPA, including investment in a greenfield multi-fuel cogeneration power plant of 50 MW and an oxygen plant at an incremental investment of US$275 million. This was scheduled to be completed within three years.

In the long term, NewZim Steel had a vision to increase the capacity of the plant up to 2,5 MTPA.

An Essar Global official told the Financial Gazette in 2012 that discussions with minorities had been initiated; they could either follow their rights by investing in the company or agree on a buyout by EAHL.

It was not immediately clear this week if these discussions had been concluded.

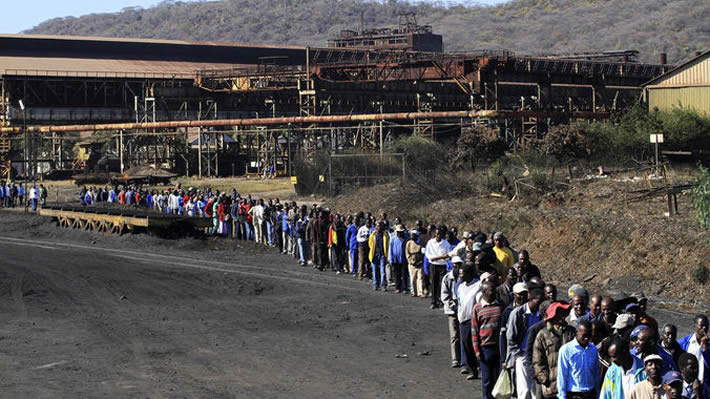

The pull-out of EAHL means the long suffering 3 000 workers of the former steel giant are likely to continue struggling to make ends meet due to non payment of salaries.

The investor paid salaries for several months before withdrawing saying they would not continue pumping out money without production.

Zisco ceased operations in 2008 due to choking financial constraints and its opening has been a matter of false starts in the past four years.

Before its collapse, Zisco was the largest integrated steel works in Africa with a capacity to produce one million tonnes of the commodity annually.

EAHL’s pullout from Zimbabwe follows hard on the heels of Rio Tinto’s exit from Murowa Diamonds and Sengwa Coal Fields, in a development that has further dampened all prospects of recovery for the country’s economy whose revival had been pegged on the mining sector after Zimbabwe’s former mainstay, agriculture, suffered in 2000. Financial Gazette