Budget stories by Golden Sibanda, Martin Kadzere, Fanuel Kangondo, Rumbidzayi Zinyuke and Walter Muchinguri

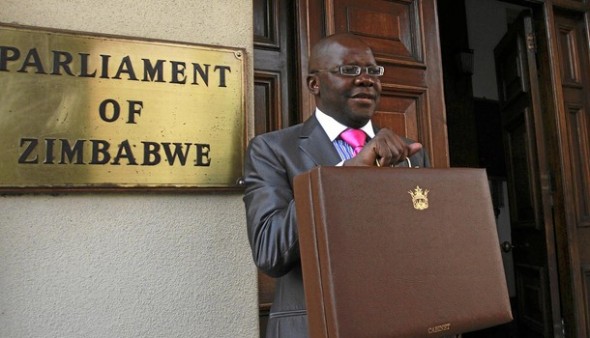

FINANCE Minister Tendai Biti yesterday raised the tax-free bonus threshold to US$1 000 from US$700 and directed banks to exempt deposits below US$800 from bank charges, as he sought to cushion the public from the harsh economic outturn.

Presenting a US$3,8 billion 2013 National Budget yesterday, Minister Biti said civil servants would be awarded an inflation-linked salary increment in January. He set aside US$50 million for both the referendum and general elections expected early next year.

The US$50 million was provided for under an unallocated reserve within his ministry’s vote. Minister Biti said in an interview that the allocation had not been split between the referendum and general elections due to issues that are yet to be ironed out.

The allocation, however, falls short of the US$220 million budget that had been submitted by the Zimbabwe Electoral Commission for elections. Of the US$220 million, US$104 million was to cover the referendum, while US$115 million was to fund the general elections.

The increase in the tax-free bonus threshold will be a huge relief for low-income earners, while the scrapping of bank charges will encourage the use of formal banking systems.

Most workers were yet to get their annual bonuses which are traditionally paid in November, as employers awaited direction from the budget statement. In addition, Minister Biti proposed that any bank deposit of at least US$1 000 held over 30 days should attract interest of a minimum of four percent per annum.

“However, to the extent that most of our people are earning salaries below the poverty datum line, it is our direction that no bank charges should be levied on any deposit of US$800 and below,” he said.

Citing the failure of banks to make reforms in terms corporate governance, low capitalisation, high interest rates, bank charges and low or no interest on savings, Minister Biti said Government was moving in to regulate on the issues.

Under the new measures to deal with the financial sector, the Reserve Bank of Zimbabwe and the Bankers Association of Zimbabwe will agree on a framework for determining interest rates and bank charges to be supported by a legal instrument.

Lending rates will be subject to a maximum rate of not more than 10 percent above a bank’s weighted average deposit rate, inclusive of all deposits.

Minister Biti said 40 percent of bank lending in Zimbabwe consists of internally generated funds from the National Social Security Authority and Old Mutual and directed that, effective January 2013, the money be extended at less than 10 percent per annum.

Banking institutions have also been ordered to repatriate 70 percent of funds held in nostro accounts as part of efforts to improve liquidity. The minister painted a gloomy picture for next year, but said Cabinet had agreed on a 15-point plan to improve economic performance next year.

The 15 points include macro-economic stability, expenditure control, attraction of foreign-direct investment, industrial competitiveness, savings mobilisation, agriculture and food security, social services, debt strategies, peace and nation building, youths and women and small to medium enterprises. Minister Biti projected the economy would grow by five percent next year, largely driven by growth in mining and agriculture.

He further revised downwards projected economic growth for this year to 4,4 percent from 5,6 percent.

Minister Biti said the 5 percent Gross Domestic Product growth was premised on the country receiving normal rains, sustainability of high commodity prices and implementation of economic programmes and holding a violence-free election.

Inflation, he said, would remain below 5 percent underpinned by a slowdown in global food prices, steady international oil prices and improved domestic capacity utilisation.

Last year, Minister Biti had projected the economy would grow by 9,4 percent, but was forced to revise the forecast downwards due to poor performance in key economic sectors, particularly agriculture and manufacturing.

To address liquidity challenges facing the industry, he said the US$40 million Distressed Industries and Marginalised Areas Fund and the US$70 million Zimbabwe Economic and Trade Revival funds would be maintained.

This comes on the back of a drop in industrial capacity utilisation from an average 57 percent to 44 percent, according to the Confederation of Zimbabwe Industries.

Recognising the linkage between the manufacturing and agricultural sectors, Minister Biti allocated about US$160 million to support the 2013 agricultural projects.

The sector is projected to grow by 6,4 percent supported by credit financing facilities to farmers and continued contract farming for tobacco, cotton, barley and soya beans. Minister Biti announced US$20 million loan facilities from CBZ Bank and Old Mutual for small to medium enterprises.

This would be in addition to US$9,4 million that has been set aside for the sector. Treasury has said the current account deficit is seen widening this year with imports projected to top US$8 billion, while exports expected to reach US$5 billion.

In a bid to close the infrastructure gap that has become a big cost to doing business in Zimbabwe, Minister Biti set aside US$350 million for capital projects. He said the Diamond Bill, which will determine how much Government will get from diamond sales, has been finalised. Herald